We just completed the slowest year for sales in my 20-year career and everyone seems stuck where they are, like a dinosaur in a tar pit. Will we stay stuck in 2024 or break free? Here’s the stats for San Diego real estate from the 4th quarter, and all of 2023, along with predictions for 2024. Always hand-written with stats direct from our local MLS.

2024 Q4 Summary

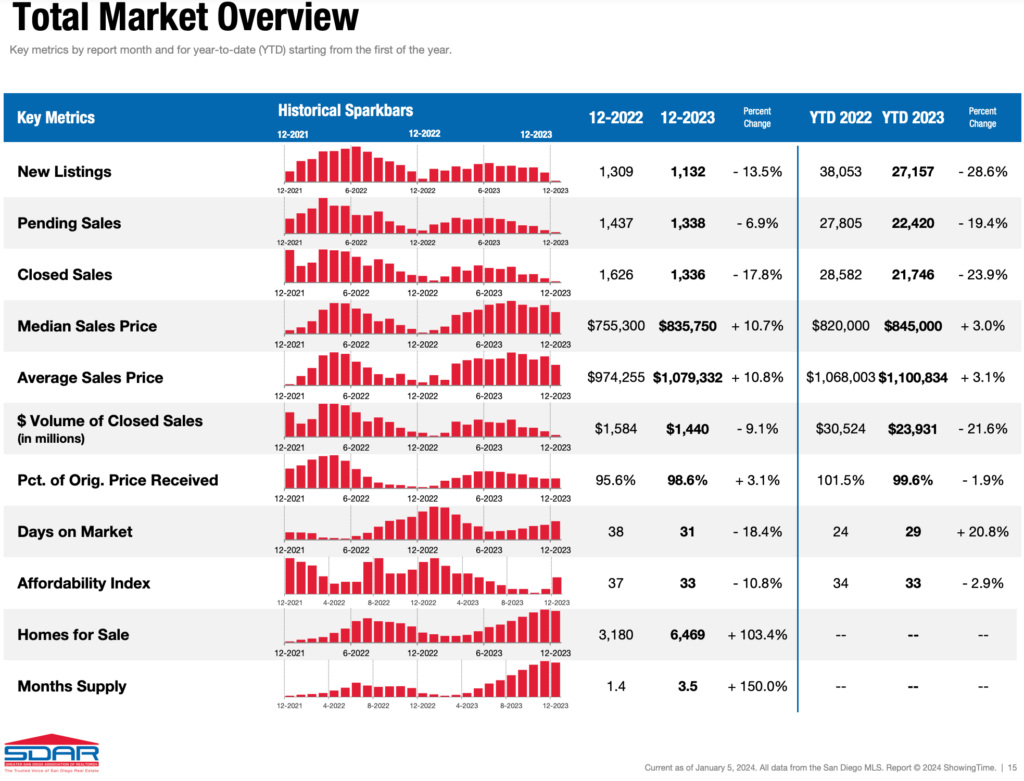

Sales Volume Down: Q4 of 2023 had 10.8% LESS closed sales than Q4 2022.

Inventory Increasing: Up 16% from end of Q3 2023. Up 103% from a year ago!

Loan Rates UP: Started 2023 at 6.45%. Ended 2023 at 6.72%

Home Values Up: Median price went from $865k to $835k in Q4. Up 10.7% from Q4 2022

Govt./Policy Changes: Fed Fund Rate stayed level the 4th quarter

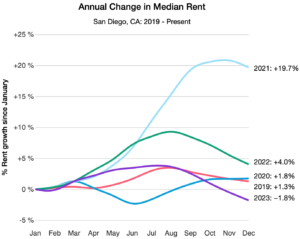

Rental Rates Down: Median Rents dropped about 3% in Q4 to end down 1.8% in 2023

The Above image is a visual summary of my statistics reference from our local San Diego Association of Realtors.

Click here to View Full Stats from San Diego Association of Realtors

2023 – Stuck in The Tar Pit

Sales Volume:

Sales Volume has been dropping for over 2 years now. Sales volume in 2021 was 39,762, in 2o22 it was 28,582 and in 2023 sales only hit 21,746. That’s a 45% drop in sales in just 2 years. The obvious reasons for a drop in sales demand are higher home loan rates + higher prices. Our affordability index hit it’s lowest point that I’ve seen in 2023, but because there is so little supply of inventory, prices have not dropped. It’s unlikely that sales numbers will come back without a notable change in the market affordability, such as a drop in loan rates or prices.

Inventory:

Inventory has been low for years, but it rose quite a bit in 2023. Inventory started rising in March and kept going all the way til December when there was finally a small pull back in inventory. Typically, inventory peaks late summer and starts declining towards the end of the year, but November was the peak of inventory in 2023.

New listings were down 28% in 2023 over 2022. The large majority of people selling are estates (dead people), divorcees as well as random relocations and a few investors ready to get out of the market. Anyone living in their home likely has an amazing home loan rate around 3%, so why would they sell their home and buy another if they will have to pay more than twice their current rate for the new home, which will barely get them much more than what they currently have? This is the tar pit that people are stuck in – it’s so financially cumbersome to sell and buy due to the increase in loan rates that the additional house you get, is not proportional to the additional payment you get. As such, people are staying put….stuck in their tar pit.

Additionally, rental rates have continued to shoot up with home values, which means homeowners (with super low rate loans) are less likely to sell if they don’t have to, even if they are moving/relocating. These would-be-sellers have become landlords.

Clearly the decrease in new listings was not enough to keep inventory low, so the climb in inventory is a relative lack of sales / demand issue. Will inventory keep climbing in 2024?

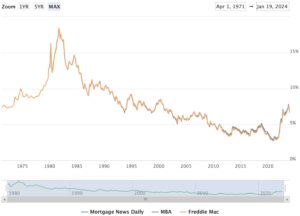

Loan Rates:

Home loan rates rose steadily most of 2023 and peaked in mid-October before they dropped pretty quickly towards the end of the year. The 30-year fixed MND rate average started 2023 at 6.45% and kept rising before it peaked at 8.03% on Oct 19. Rates quickly dropped for the next 2 months before flattening out and ending the year at 6.72%.

Will rates come down further in 2024? Most pundits are expecting rates to improve in 2024 but not until the 3rd or 4th quarter of the year, which sounds about right to me. I believe that inflation needs to drop a bit more and/or the economy needs to stumble before the MND rate average gets down to 6% or below again. But when and if….?

Home loan rate charts:

Long Term Rate Chart: 1971 – 2024 Short Term Rate Chart: 2023

Govt / Policy Changes:

Raising the Federal Funds rate continues to be the Fed’s main weapon against inflation. Inflation has dropped considerably in 2023, but it’s not quite to the point where the Fed is satisfied. If we see any more rises in inflation in the short-term, it’s likely to be followed by another .25 rate hike. The Fed last raised the rate .25 in July but did not raise it during the 3rd or 4th quarter. While many of us in the industry are optimistic they are at the end, The Fed has indicated they are in a wait and see mode.

Home Values:

Home Values were on the upswing most of 2023. Unlike 2022 where we peaked late spring, prices kept rising through the end of the summer and peaked in August 2023 with a new median home value high for detached homes of $1,015,000. Home values also didn’t drop as quickly as they did in 2022 after the peak so we ended the year up 10.7% start to finish.

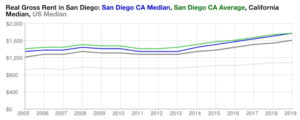

Rental Prices:

Monthly median rent peaked mid-summer up nearly 4% from the start of the year, but then dove hard towards the end of the year to end down 1.8% year over year. Rents have been climbing for over 10 years, so it’s no surprise to see the market pullback a bit. Also, with rates dropping the last few months, the sales market looks (a little) more attractive.

All that said it’s completely normal seasonally for the rental market to die in December. Will it come back strong & fast in 2024?

Median Rent SD: 2019-Present Median Rents SD, CA, USA: 2005-2019

Commercial Real Estate:

As some of you know, I’ve been getting more experience with commercial real estate (offices, apartment buildings, business leases) and have an experienced Broker of 30+ years as a partner & resource. The commercial real estate sales market was really quiet this year, not unlike the residential market. On top of increasing loan rates and increasing costs of construction, investors can get guaranteed returns over 5% in Treasury bills & high interest deposits with their cash, which has further put the brakes on the sales market. Industrial real estate is still in relatively high demand and a strong market. Small-sized retail is seeing the standard churn of small businesses and is keeping somewhat busy, but big box retail leasing is slowing down.

You know I do residential, but please also think of me when you want to buy or lease a place for your business.

What does the future hold? My theories & predictions are below…

Of course, these are just predictions….that said, I think we will see a somewhat slow start to the year with minimal changes in inventory, rates, prices or sales. Near the end of Q1 and into Q2, the market is likely to heat up as the spring often does and pent up demand starts showing it’s face. There will be more inventory and more sales. I can’t tell if I’m hopeful or genuinely believe that rates will soften and sales will increase in the 2nd half of the year – hope is a wonderful thing, but I feel too biased right now to make strong predictions. In an effort at objectivity, I will predict a seasonal upswing of about 3-5% in the first half of 2024.

I’m expecting rates to stay fairly stable in the short-term and hover around 6.5-7.0% I predict a slight drop in rates towards the 2nd half of the year more into the 6-6.5% range. There are definitely a number of would be buyers on the sidelines and their decision to buy or not is financial and rate dependent. As such, any big move in the home loan rate market is going to have a major effect on the sales market.

Rents slid down quite a bit at the end of 2023. While a dip is normal the last 2-3 months of the year, we dipped fast, so I’m expecting a little bump in Q1 and Q2, but I think we will see rents dip again, below their starting point by the end of 2024.

Want a free lunch?

If you got this far and read my entire article, please let me know what you think with an email/text/call. You’ve got a free lunch coming to you!

And thank you for your referrals – they are the foundation of my business at over 90% the last 10 years.

Adam Pascu

Broker / Owner

73 Degrees Realty

858-761-1707

ps. feel free to check out my San Diego Green Homes site if you have a passion for living green/sustainably and contact me (cell: 858-761-1707) for a free consult regarding how to green your home.